Understanding the Mortgage Maze: A Beginner’s Tale

Hello! If you’re like many professionals over 35, you may be considering the concept of dwelling possession and the complexities concerned in U.S. mortgage financing. So, go forward and pour your self a cup of espresso and let’s dive right into a dialogue about this thrilling and rewarding journey.

What Exactly is Mortgage Financing?

In easy phrases, a mortgage is a mortgage particularly used to buy a home. The home itself serves as collateral. This means if you happen to do not sustain along with your funds, the lender can take the home again. But let’s not dwell on that! Instead, let’s have a look at how one can take advantage of informed decisions.

TIP BOX:

Did You Know?

The phrase “mortgage” actually means “dying pledge” in Old French. But don’t fret, it’s not as scary because it sounds!

Types of Mortgages: Finding Your Perfect Match

Fixed-Rate Mortgages

These have an interest rate that continues to be the identical all through the lifetime of the mortgage. It’s like having your favourite playlist on repeat—predictable and comforting.

Popular

Adjustable-Rate Mortgages (ARMs)

The fee right here can change, normally after an preliminary fastened interval. Think of it just like the climate—generally sunny, generally a bit cloudy.

Comparison Table: Fixed vs. Adjustable-Rate Mortgages

| Feature | Fixed-Rate | Adjustable-Rate (ARM) |

|---|---|---|

| Interest Rate Stability | Stable | Variable |

| Initial Interest Rate | Higher | Lower |

| Payment Predictability | High | Low |

Navigating the Mortgage Application Process

Applying for a mortgage might sound daunting however it’s kind of like getting ready a presentation. Gather your paperwork, know your stuff and you will be simply fantastic!

- Check Your Credit Score

Before the rest, ensure your credit score is in fine condition. A better score can mean better interest rates. Check it such as you would verify your favourite sports activities crew’s stats earlier than a giant game. - Get Pre-Approved

This gives you a clear idea of how a lot you may afford and reveals sellers you’re critical. It’s like having a VIP cross at a live performance! - Choose the Right Lender

Don’t simply go along with the primary lender you meet. Shop round such as you would for the proper pair of footwear.

REAL-WORLD STORY:

Meet Jane, a tech marketing consultant from Boston. She spent a month researching lenders and ended up saving hundreds in curiosity over the lifetime of her mortgage. Jane’s recommendation? “Don’t rush. The proper lender is on the market!”

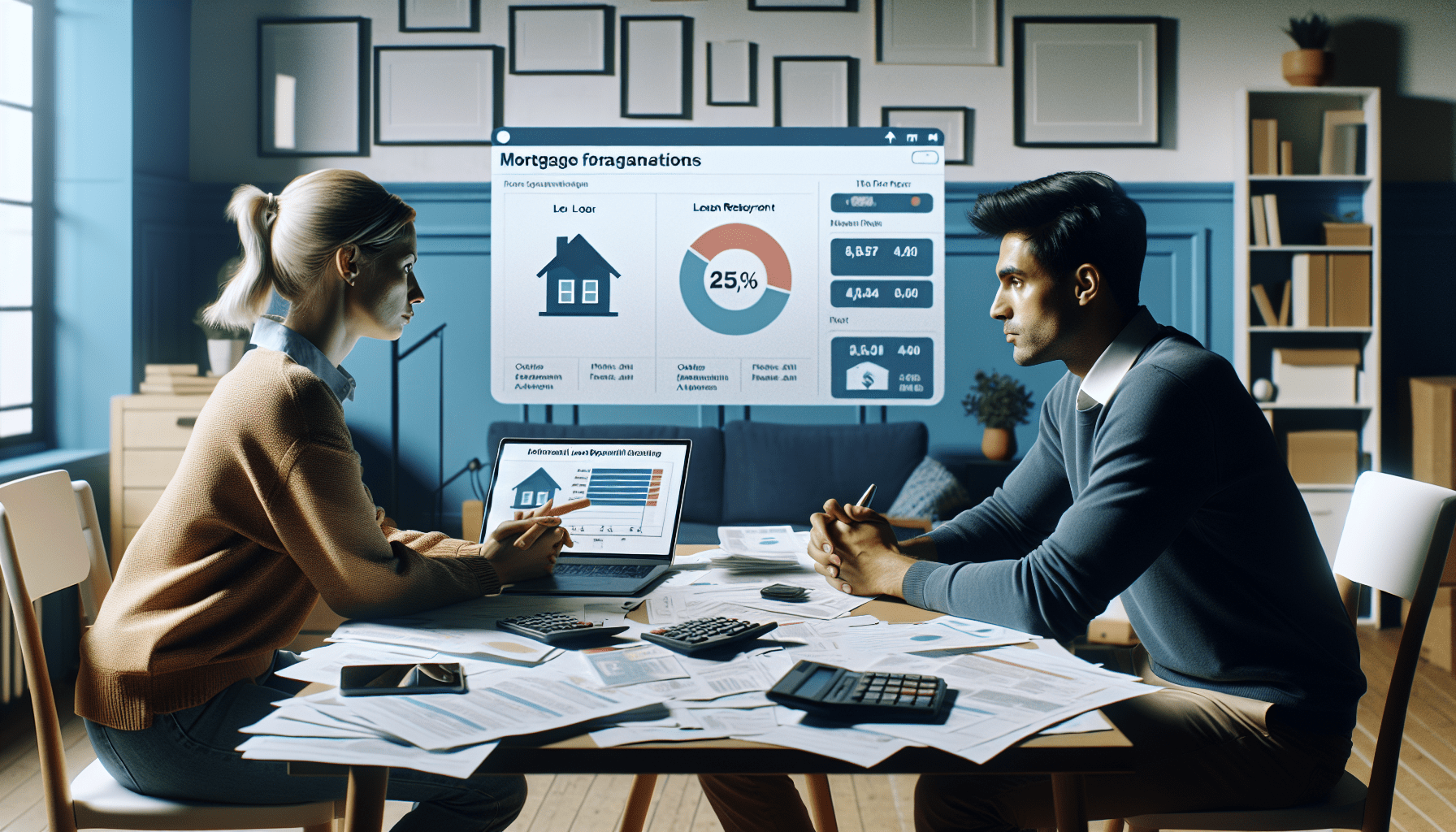

Boost Your Knowledge with Interactive Tools

Mortgage Calculator

See how completely different charges and phrases have an effect on your month-to-month cost and whole curiosity. It’s like having a monetary GPS in your home-buying journey.

Poll

What’s your greatest concern about getting a mortgage?

- Interest charges

- Down payment

- Understanding phrases

Wrapping It Up

Navigating the world of U.S. mortgage financing doesn’t have to be overwhelming. With the correct info and instruments, you can also make knowledgeable, assured selections. Remember, each journey begins with a single step—or on this case, a single signature on a mortgage settlement!

Call to Action:

Ready to take the following step? Discover how our mortgage calculator may help you discover your excellent dwelling financing answer at present!

External Links

- Learn extra about mortgage refinancing here.

- Check out this expert study on mortgage tendencies.