Understanding Economics and the Stock Market: A Comprehensive Guide

Understanding Economics and the Stock Market: A Comprehensive Guide

In this moment’s dynamic monetary panorama, the intricacies of economics and the inventory market are essential for buyers, professionals, and anybody involved in the functioning of worldwide markets. By filling in the gaps in the present literature and offering recent views, this thorough information seeks to analyze these topics in a nice element.

Understanding Economics and the Stock Market: A Comprehensive GuideIntroduction to Economics and the Stock Market

Economics and the inventory market are deeply intertwined. Understanding their relationship helps buyers make knowledgeable choices and anticipate market developments. This information covers the elementary ideas, present developments, and sensible functions related to each field.

Key Concepts in Economics

1. Basic Economic Principles

- Supply and Demand: The elementary financial maneuver explains how costs and portions of products and companies are decided in a market economic system.

- Market Equilibrium: The level at which the amount demanded equals the amount provided.

- Elasticity: Measures how the amount demanded or provided of an excellent responds to adjustments in value.

2. Economic Indicators

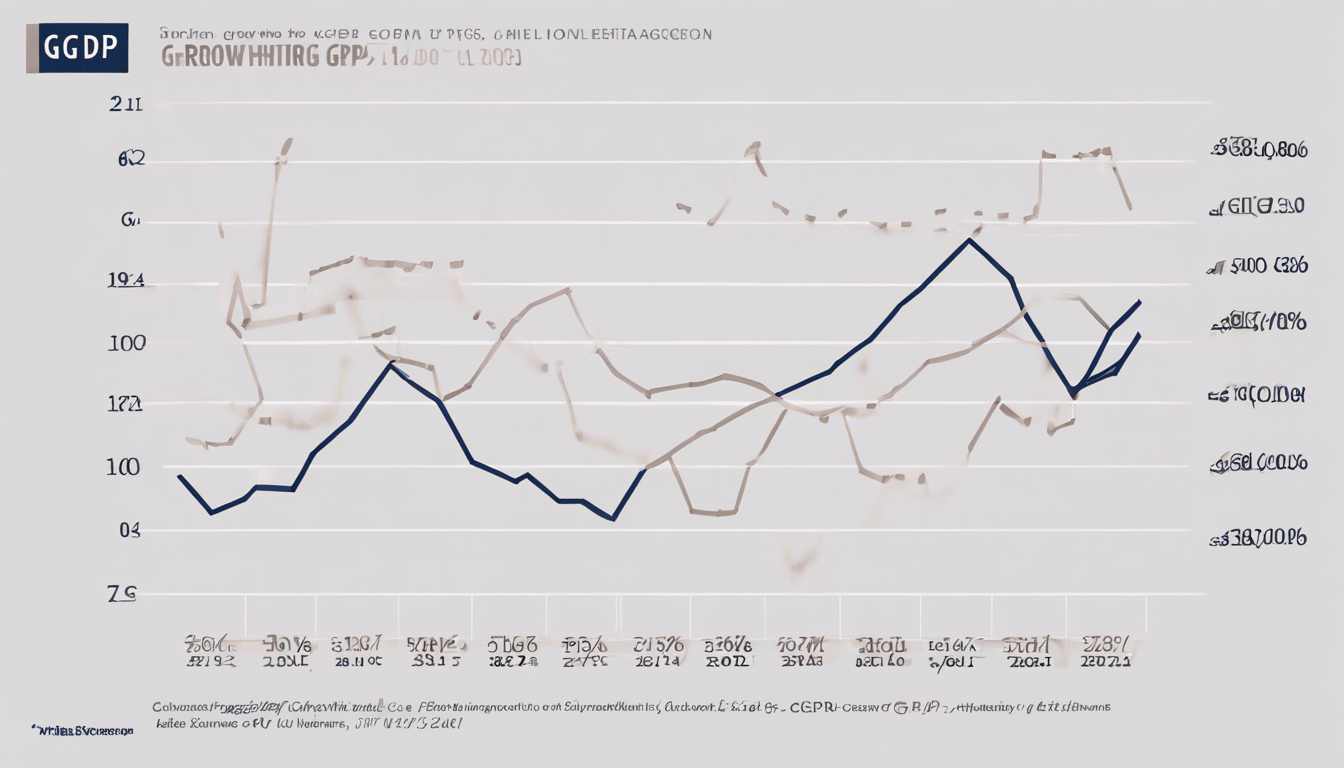

- Gross Domestic Product (GDP): A measure of a rustic’s financial efficiency.

- Inflation: The price at which the basic stage of costs for items and companies is rising.

- Unemployment Rate: The proportion of the labor force that’s jobless and actively in search of employment.

3. Economic Theories and Models

- Keynesian Economics: Focuses on whole spending in the economic system and its results on output and inflation.

- Classical Economics: Emphasizes free markets, minimal authorities intervention, and the long-term results of market equilibrium.

- Monetarism: Centers on the position of governments in controlling the sum of money in circulation.

The Stock Market: An Overview

1. Understanding Stock Markets

- Definition: An inventory market is a group of markets in which shares (shares of possession in companies) are purchased and bought.

- Major Exchanges: This contains the New York Stock Exchange (NYSE), NASDAQ, and London Stock Exchange (LSE).

2. How the Stock Market Works

- The dynamics of supply and demand, firm efficiency, and financial components all affect inventory costs.

- Market Indices: Aggregated measures of inventory efficiency resembling the S&P 500, Dow Jones Industrial Average, and NASDAQ Composite.

- Fundamental evaluation determines the intrinsic worth of an inventory by inspecting its monetary statements, trade standing, and general state of the economic system.

- Technical Analysis: Uses historic value knowledge and buying and selling volumes to foretell future value actions.

- Diversification: Spreads investments throughout numerous sectors to cut back on threats.

Current Trends and Data

1. Impact of Technology on Markets

- Algorithmic Trading: Automated buying and selling methods that use algorithms to make high-speed buying and selling choices.

- Fintech Innovations: The rise of economic expertise instruments resembling robo-advisors and blockchain.

- Geopolitical Events: How political instability and worldwide relations affect markets.

- Climate Change: The rising significance of environmental, social, and governance (ESG) components in funding choices.

3. Post-Pandemic Market Dynamics

- Recovery Trends: Analyzing how completely different sectors are bouncing again from financial disruptions brought on by the COVID-19 pandemic.

- Remote Work and Its Effects: The shift in direction of distant work and its implications for the actual property and expertise sectors.

Practical Advice for Investors

1. Building a Portfolio

- Risk Tolerance: Assessing your capacity to endure market volatility.

- Investment Goals: Aligning investments together with your long-term monetary goals.

- Emotional Investing: Avoid making choices based mostly on short-term market actions or feelings.

- Lack of Research: Conduct thorough analysis earlier than investing in shares or different monetary devices.

3. Staying Informed

- Economic Reports: Regularly reviewing financial indicators and monetary information.

- Continuous Learning: Engaging in instructional assets and monetary literacy applications.

Conclusion

Understanding the fundamentals of economics and the inventory market is important for making knowledgeable monetary choices. Through diligent exploration of those topics and ongoing consciousness of the latest developments, folks can enhance their funding approaches and deftly maneuver the intricacies of the modern monetary panorama.

Internal Linking Opportunities

- Economic Indicators Explained: Link to an in-depth web page about numerous financial indicators.

- Investing Strategies 101: Link to a web page overlaying completely different investing methods in depth.

- Understanding Market Indices: Link to a useful resource explaining main inventory market indices.

External Authoritative Sources

- Investopedia: Basic Economic Principles: An Overview of Essential Economic Concepts.

- The Wall Street Journal: Market Trends: To keep up to date with the newest market developments and information,

- Bureau of Economic Analysis: GDP Data: Official knowledge on GDP and financial efficiency.

- For detailed advice and investment strategies, visit Morningstar: Investment Strategies.

- World Bank: Global Economic Outlook: Insights into world financial circumstances and forecasts.

This article gives a complete and up-to-date look at economics and the inventory market, filling gaps in present content material and providing actionable insights for readers.

Frequently Asked Questions (FAQ) about Economics and the Stock Market

1. What are the fundamental ideas of economics?

Basic financial ideas embrace provide and demand, market equilibrium, and elasticity. Supply and demand clarify how costs and portions of products and companies are decided. Elasticity measures how value adjustments affect the amount demanded or provided. Market equilibrium is the level at which the place provides and demands is equal.

2. How do financial indicators impression the inventory market?

Economic indicators resembling GDP, inflation, and unemployment charges present insights into the general well-being of an economic system. A strong GDP progress price, for instance, might point out a thriving economic system, which might bolster investor confidence and increase inventory costs. Conversely, excessive inflation or rising unemployment might point out financial bother, doubtlessly resulting in a market downturn.

3. What is the position of expertise in fashionable inventory markets?

The technology considerably impacts inventory markets by way of algorithmic buying and selling, which makes use of advanced algorithms to execute trades at excessive speeds, and fintech improvements like robo-advisors and blockchain, which supply new methods to handle investments and improve transparency.

4. What are some frequent investing methods?

Common investing methods embrace:

- Fundamental Analysis: Evaluate an inventory’s intrinsic worth based mostly on monetary statements and financial circumstances.

- Technical Analysis: analyzes historic value and quantity knowledge to foretell future inventory actions.

- Diversification: Spreads investments throughout numerous sectors to reduce threat.

5. How can I construct a profitable funding portfolio?

To construct a profitable funding portfolio, assess your threat tolerance, set clear funding targets, and diversify your investments throughout completely different asset classes and sectors. Regularly evaluate and regulate your portfolio based mostly on market circumstances and private monetary goals.

6. What are some frequent pitfalls to keep away from in investing?

Emotional investing, which can lead to snap choices based mostly on market fluctuations, and an absence of analysis, which might result in uninformed funding choices, are frequent pitfalls. It’s essential to make choices based mostly on thorough evaluation and long-term goals.

7. How does the COVID-19 pandemic affect the inventory market?

The COVID-19 pandemic has led to vital market volatility, affecting numerous sectors differently. Some industries, like expertise and healthcare, have seen progress, whereas others, resembling journey and hospitality, have confronted challenges. Investors ought to monitor restoration developments and sector-specific impacts when making funding choices.

8. What are market indices, and why are they vital?

Market indices, resembling the S&P 500, Dow Jones Industrial Average, and NASDAQ Composite, mixture the efficiency of a choice of shares to supply a summary of market developments. They are vital for gauging general market efficiency and evaluating particular person inventory efficiency towards a broader market benchmark.

9. How can I keep knowledgeable about financial and market developments?

Staying knowledgeable entails repeatedly reviewing financial stories, monetary information, and updates from credible sources resembling funding websites, financial analysis organizations, and monetary information retailers. Continuing schooling through programs and monetary literacy initiatives will also be helpful.

10. What are some dependable sources for financial and inventory market knowledge?

Reliable sources embrace:

- Investopedia for financial ideas and funding methods.

- The Wall Street Journal for present market developments and information.

- The Bureau of Economic Analysis is accountable for GDP and financial efficiency knowledge.

- recommendationsMorningstar for funding methods and recommendations.

- The World Bank for world financial outlook and forecasts.

I love this blog, keep posting articles like this!

This post really helped me understand the topic. Thank you!

This article is both informative and enjoyable to read.

I learned a lot from this article, thanks for your expertise.

Thanks for this very useful and well-written post.

A clear and insightful read, keep publishing content like this!

Keep writing such interesting and relevant articles!

Thanks for this very useful and well-written post.

Keep writing such interesting and relevant articles!

It’s so well-written and clear! I really enjoyed this post.

Thanks for sharing this valuable content. Very well structured and easy to read!

Thanks for this post. It’s both comprehensive and easy to understand.

Thank you for this well-structured and clear content. By the way, if you’re looking for more great content, check out this site: https://www.gagnerargent.online/transformer-100-en-1000-euros/.

Your expertise shines through in every sentence, thank you for this post.

Thanks for sharing this valuable and informative content. I’ll be back regularly!

This post really helped me understand the topic. Thank you!

Kudos on this article! It’s packed with useful, well-explained information.

I learned a lot from this article, thanks for your expertise.

You have a unique way of approaching complex topics. By the way, if you’re looking for more great content, check out this site: https://commentgagner.blog/revenus-avec-linvestissement-en-dividendes/.

This post really helped me understand the topic. Thank you!

Thanks for sharing this valuable content. Very well structured and easy to read!

Thank you for this post! I love how you make complex topics easy to understand. By the way, if you’re looking for more great content, check out this site: https://www.finanalys.com/10-must-read-finance-books/.

This post really helped me understand the topic. Thank you!

Keep writing such interesting and relevant articles!

The illustrations and examples add real value to this article, thank you!

This article is incredibly well written! I learned a lot by reading it.

Superb article. I’ve learned so many new things today. Thanks!

It’s always a pleasure to read your posts. Keep educating us!

Your writing is really engaging, I was hooked from start to finish.

You have a unique way of approaching complex topics.

A very insightful analysis, I appreciate your perspectives.

I recommend this blog to anyone who wants to learn more about this topic.

This site is now my reference for this kind of information. Excellent work!

I won’t hesitate to return to this blog to read your next articles.

This is exactly what I needed to better understand this topic.

You have a unique way of approaching complex topics. By the way, if you’re looking for more great content, check out this site: https://www.finanalys.com/real-estate-investment-strategies/.

I won’t hesitate to return to this blog to read your next articles.

I appreciate the clarity and structure of this article, it is easy to follow. By the way, if you’re looking for more great content, check out this site: https://www.shortener.cloud/influence-of-twitter-on-viral-content/.

I like the accessible tone of your articles, thank you for making this topic understandable.

A very well researched article, with reliable and complete information.

I will definitely be coming back to this site for more content like this.

Thank you for this exceptional work. It’s an enjoyable and informative read.

It’s so well-written and clear! I really enjoyed this post. By the way, if you’re looking for more great content, check out this site: https://www.codetalenthub.io/custom-angularjs-web-app-development/.

Your blog is a real gold mine for information on this topic.

This is exactly the type of post I was looking for. Thank you so much! By the way, if you’re looking for more great content, check out this site: https://commentgagner.blog/location-saisonniere-101/.

Your blog is now my reference for this kind of information.

Thanks for this post. It’s both comprehensive and easy to understand.

Thank you for this post! I love how you make complex topics easy to understand.

This article is both informative and enjoyable to read.

This site is now my go-to for this kind of information. Great work!

Your blog is a real treasure trove for information on this topic. By the way, if you’re looking for more great content, check out this site: https://insurancego.store/health-insurance-plans-for-families/.

Kudos on this article, I’ll be sharing it with my colleagues.

You made a complex topic very simple to understand. Well done! By the way, if you’re looking for more great content, check out this site: https://www.gagnerargent.online/monetiser-votre-creativite/.

This post really helped me understand the topic. Thank you!

Thank you for this post! I love how you make complex topics easy to understand.

A very well researched article, with reliable and complete information. By the way, if you’re looking for more great content, check out this site: https://www.shortener.cloud/amazon-prime-shipping-time-benefits/.

Thank you for sharing this valuable content. Very well structured and easy to read! By the way, if you’re looking for more great content, check out this site: https://commentgagner.blog/le-guide-ultime-du-marketing-daffiliation/.

Thanks for sharing this valuable content. Very well structured and easy to read!

This article is both informative and enjoyable to read.

It is always a pleasure to read your articles. Keep teaching us!

I highly recommend this blog to anyone interested in this topic. By the way, if you’re looking for more great content, check out this site: https://commentgagner.blog/location-immobiliere-101/.

Thank you for these step-by-step explanations, it makes everything so much clearer!

I highly recommend this blog to anyone interested in this topic. By the way, if you’re looking for more great content, check out this site: https://www.aiearner.co/ai-data-analytics/.

This site is now my reference for this kind of information. Excellent work!

Your blog is now my reference for this kind of information.

Quality content, which I will not hesitate to recommend to others. By the way, if you’re looking for more great content, check out this site: https://commentgagner.blog/createur-de-contenu-a-succes/.

Thanks for this post. It’s both comprehensive and easy to understand.

I recommend this article to anyone who wants to learn more about this topic!

I will definitely be coming back to this site for more content like this.

Up-to-date and well-organized information, very useful for me.

Keep sharing such valuable and well-structured content.

Thank you for this post! I love the way you make complex topics easy to understand.

Thank you for this exceptional work. It’s an enjoyable and informative read. By the way, if you’re looking for more great content, check out this site: https://www.finanalys.com/key-financial-terms/.

Thank you for this post! I love the way you make complex topics easy to understand.

You really have a unique way of approaching complex topics.

This was a very enlightening read, thanks for your work.

A clear and informative read, keep posting content like this! By the way, if you’re looking for more great content, check out this site: https://insurancego.store/health-insurance-premiums-definitive-guide-2024/.

This site is a real resource of information, thank you very much!

Thank you for this comprehensive analysis, it was a great help to me.

An excellent article, very well researched and easy to read.

Thank you for this precise lighting, it answers my questions exactly.

This article really enlightened me on the subject, thank you for this detailed approach!

An excellent article, I highly recommend it to all my friends. By the way, if you’re looking for more great content, check out this site: https://commentgagner.blog/devenir-un-freelancer-a-succes/.

Congratulations for this article, I will share it with my colleagues.

A great article, I highly recommend it to all my friends.

Your blog is now my reference for this kind of information.

Thank you for the accuracy and depth of this analysis.

Thank you for sharing this valuable content. Very well structured and easy to read!

The illustrations and examples add real value to this article, thank you!

A very insightful analysis, I appreciate your perspectives. By the way, if you’re looking for more great content, check out this site: https://www.gagnerargent.online/creer-du-contenu-qui-convertit/.

A clear and detailed approach, exactly what I needed.

Always so well written, I appreciate the quality of your content.

Thanks for sharing this valuable and informative content. I’ll be back regularly!

The concrete examples make the reading very informative, well done!

Your expertise is felt in every sentence, thank you for this article. By the way, if you’re looking for more great content, check out this site: https://www.gagnerargent.online/augmenter-revenus-avec-un-seo-optimise/.

Kudos on this article, I’ll be sharing it with my colleagues. By the way, if you’re looking for more great content, check out this site: https://www.aiearner.co/ai-affiliate-marketing/.

Thank you for sharing this valuable content. Very well structured and easy to read!

A clear and insightful read, keep publishing content like this! By the way, if you’re looking for more great content, check out this site: https://www.gagnerargent.online/referencement-et-succes-financier/.

Thank you for these step-by-step explanations, it makes everything so much clearer!

Thank you for this well-structured and clear content.

Thank you for this post, very enriching and easy to follow.

Thank you for these step-by-step explanations, it makes everything so much clearer! By the way, if you’re looking for more great content, check out this site: https://www.gagnerargent.online/creer-des-revenus-passifs/.

This blog is an essential reference for me from now on.

I learned so many new things from reading this post. By the way, if you’re looking for more great content, check out this site: https://www.gagnerargent.online/boostez-revenus-grace-a-seo/.

A clear and insightful read, keep publishing content like this!

Thank you for this article, it allowed me to better understand a complex subject.

This article really helped me understand the topic. Thank you!